Proposed Changes to affect Shareholders in a Company

Recently the Treasury released a consultation paper proposing changes to the treatment of complying Debit Loans to Shareholders in a Company (Division 7A loans). The recommendation is that the proposed changes will come into effect on 1 July 2019.

Division 7A is part of the Income tax Assessment Act 1936 and is intended to prevent profit or assets being provided to shareholders or their associate/(s) tax free. A complying Division 7A loan is a loan that is on the basis of a written agreement with terms. The loan must be converted to a complying loan by the day the company lodges its income tax return or the due date for lodgement, whichever is earlier.

Proposed changes

The 10-year loans would effectively begin at the end of the income year in which the advance is made, this is consistent with current practice. This will allow sufficient time to put the loan on complying terms before the due date of the tax return.

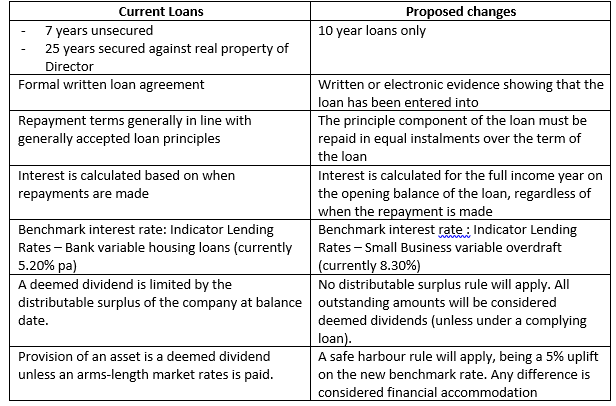

The proposed changes for complying Division 7A loans are:

The following set out what the effect of the changes will be:

Say there are 3 loans:

- Pre-1997 loan of $120,000

- 2017 loan of $50,000 – Balance at 30/06/2019 is $37,491

- 2018 loan of $40,000 – Balance at 30/06/2019 is $35,117

Division 7A rules currently

The benchmark interest rate is 5.2% pa.

The minimum repayment for the year will be:

- 2017 loan = $8,707

- 2018 loan = $6,963

Total repayments = $15,670

The interest charged on the loans will be:

- 2017 loan = $1,950

- 2018 loan = $1,826

Total Interest = $3,776

If proposed changes go ahead

Benchmark interest will increase to 8.3%

The principle repayment is reduced by an equal amount each year

The minimum repayment for the year will be:

- 2017 loan = $10,610

- 2018 loan = $8,768

Total repayments = $19,378

The interest charged on the loans will be:

- 2017 loan = $3,112

- 2018 loan = $2,915

Total Interest = $6,027

If the proposed rules are made into law, an additional minimum repayment of $3,708 would be necessary and extra interest of $2,251 would be charged.

Transitional rules

7 year unsecured loans

All complying 7 year loans at 30 June 2019 must comply with the new proposed loan model:

- The new benchmark interest rate is to be used

- The existing outstanding term will retained

- The principle repayment must be in equal instalments over the loan term

25 year secured loan

These loans will be exempt form from the majority of changes until 30 June 2021, but for:

- The new benchmark interest rate is to be used between 1 July 2019 and 30 June 2021

On 30 June 2021, the outstanding value of the loan will become 10 year loans.

Pre-1997 loans

A two-year grace period will apply to these loan, therefore a pre-1997 loan will need to be converted to a 10 year loan from 30 June 2021.

Conclusion

Even though these proposals are only in consultation phase at the moment, there has been multiple announcements in previous years of an intention to change the law.

Importantly, these proposals are scheduled to come into effect from 1 July 2019, meaning there may be a short turnaround before the measures become law.

With these proposals in mind, we would like to review your current situation with a view to put strategies in place in anticipation of these changes.

Please contact us to make an appointment so that we can discuss how this will affect your situation.

The Money Edge | Bundaberg

.png)

.png)

.png)