Budget 2020/2021: Proposed Individual Tax Rate Changes

Personal Income Tax Rates

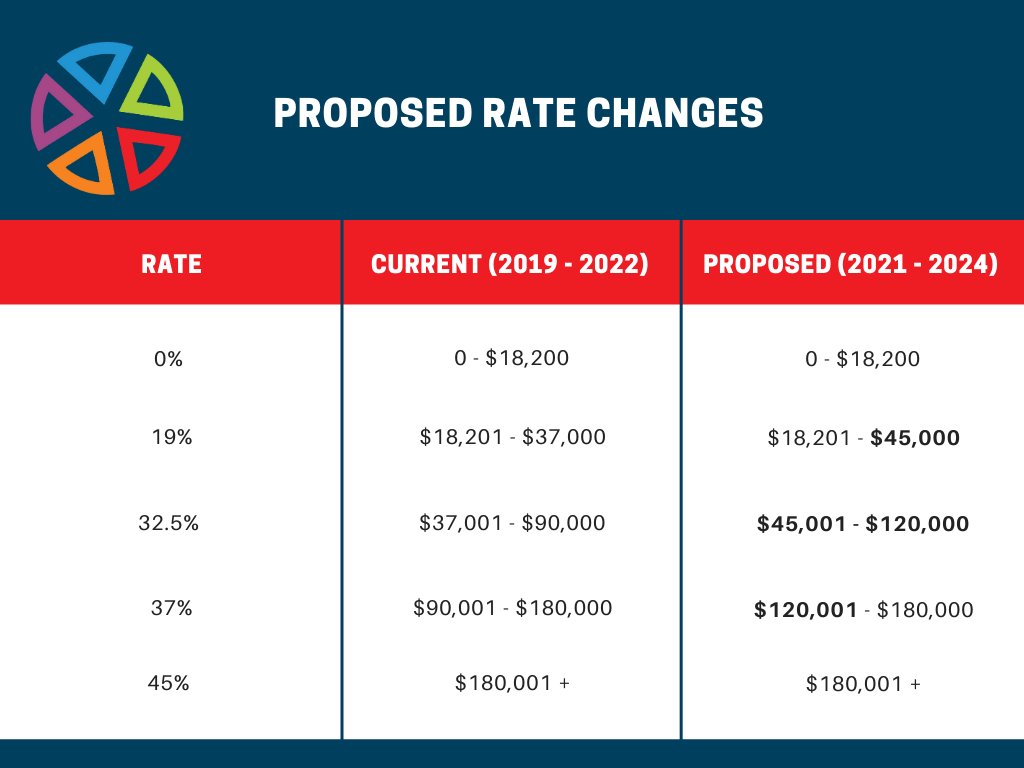

The Government has announced that it will bring forward changes to the personal income tax rates that were due to apply from 1 July 2022, these changes now apply from 1 July 2020 (2021 FY).

- increasing the threshold of the 19% personal income tax bracket from $37,000 to $45,000

- increasing the threshold of the 32.5% personal income tax bracket from $90,000 to $120,000.

These changes are illustrated in the following table (which excludes the Medicare Levy).

Changes to the Low Income Tax Offset

The Government announced that it will also bring forward the changes that were proposed to the LITO from 1 July 2022, so that they will now apply from 1 July 2020 (2021 FY), as follows:

- The maximum LITO will be increased from $445 to $700.

- The increased (maximum) LITO will be reduced at a rate of 5 cents per dollar, for taxable incomes between $37,500 and $45,000.

- The LITO will be reduced at a rate of 1.5 cents per dollar, for taxable incomes between $45,000 and $66,667.

For any clarification needed or queries you may have please call us at the office on 07 4151 8898.

The information contained in this document is for general information purposes only, and should not be used as a substitute for

consultation with professional advisors. The information contained is not intended to address the circumstances of any particular

individual or entity and is not to be relied upon by individuals or any other entity in making financial or investment decisions.

Individuals and other entities should seek appropriate professional advice tailored to their circumstances in making financial decisions.

Although The Money Edge has taken care in creating this document, no guarantee is given as to its accuracy, currency or correctness. The

Money Edge is under no obligation to update any information included in this document. To the extent permissible by law, The Money Edge and

its associated entities shall not be held liable for any for any errors, omissions, defects or misrepresentations in the information

contained in this document, or any loss or damage, however caused, suffered or incurred by persons who rely on information in this document

for any purpose.

.png)

.png)

.png)