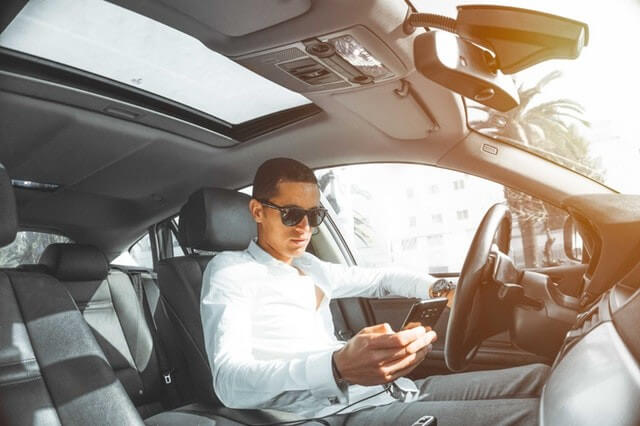

ATO contact regarding business cars and Fringe Benefits Tax (`FBT’)

The ATO has recently advised that it will be contacting taxpayers (and tax agents on behalf of their clients) that have been identified as having cars registered in their business name who have not lodged an FBT return. The ATO has reminded businesses that: a car fringe benefit will occur when a business owns or […] Read More…

).png)

.png)

.png)